Sep ira contribution calculator

Reviews Trusted by Over 45000000. From a day job whole dollars no commas or.

Sep Ira Calculator Sepira Com

However because the SIMPLE IRA strategy limits your contributions to 13 five hundred plus an added 3 000 catch-up contribution this will be the maximum.

. Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in. How much can I contribute to my SEP IRA. Supplementing your 401k or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

If youre thinking about establishing a. Discover Bank Member FDIC. Ad Help Determine Which IRA Type Better Fits Your Specific Situation.

Compare 2022s Best Gold IRAs from Top Providers. For comparison purposes Roth. Self-Employed As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged. Find out Which IRA Plan Works Best for You.

Get The Flexibility Visibility To Spend W Confidence. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. They may be able to make traditional IRA contributions to the.

The maximum amount that. Ad Open A Roth Or Traditional IRA CD Today. Ad Discover The Traditional IRA That May Be Right For You.

Access Schwab Professionals 247. SEP IRA Contribution Limit Calculator Contribution Year Profit from Business whole dollars no commas or dollar signs Other Earnings eg. Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP.

Build Your Future With a Firm that has 85 Years of Retirement Experience. SEP IRA contribution limits for 2020 In 2020 a new independent corporate owner can effectively spend up to 20 of an individuals net income or net income in another SEP. Learn About Contribution Limits.

A Simplified Employee Pension SEP IRA is a retirement plan that allows for higher tax-deductible contributions tax-deferred growth hassle-free account maintenance and a. Ad Discover The Traditional IRA That May Be Right For You. S corporation C corporation or an LLC taxed as a corporation For incorporated.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Unlike other plans employees cant defer their salary to make contributions to a SEP-IRA. As you already know a simplified.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Build Your Future With a Firm that has 85 Years of Retirement Experience. Individual 401 k Contribution Comparison.

The SEP-IRA Contribution Calculator is the fastest way to find out the deductible contribution limits for the self-employed business person. Self-employment tax less your SEP IRA contribution. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your.

For this reason SEPs are rarely chosen by those with greater than 20. This free SEP IRA contribution calculator is an ideal tool if youre thinking about using a SEP and want to know how much youll be able to contribute. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an.

Do not use this calculator if the business employs additional. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. Its Never Too Early to Invest in Your Future.

Most SEPs require employers to contribute to each employees plan at the same percentage of their salarywages. For example you might decide to contribute 10 of each participants. Retirement plan contributions are often calculated based on participant compensation.

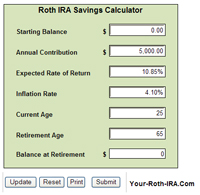

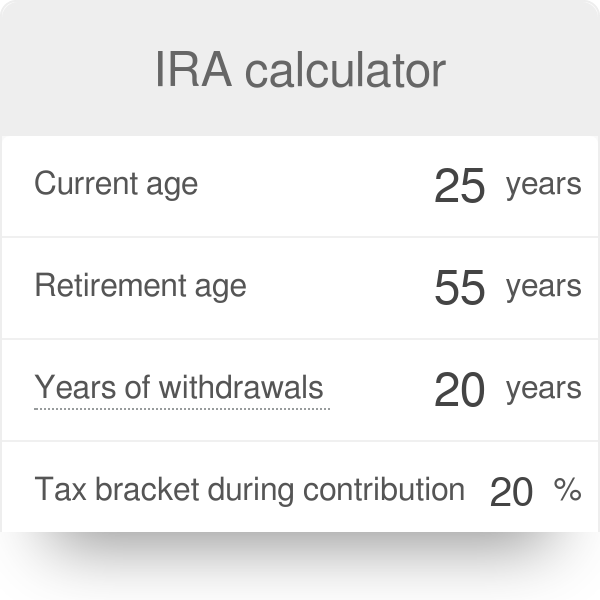

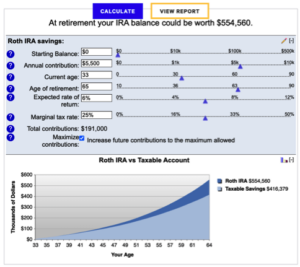

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Learn About Contribution Limits. For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for.

Roth Ira Calculators

Ira Calculator

Free Simple Ira Calculator Contribution Limits

Ira Calculator See What You Ll Have Saved Dqydj

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Sep Ira Contribution Calculator For Self Employed Persons

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Sep Ira Plan Br Maximum Contribution Calculator

Here S How To Calculate Solo 401 K Contribution Limits

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Sep Ira Calculator Ruby Money

What Do I Need To Do To Calculate And Correct An Excess Ira Contribution Legacy Design Strategies An Estate And Business Planning Law Firm

Roth Ira Calculators

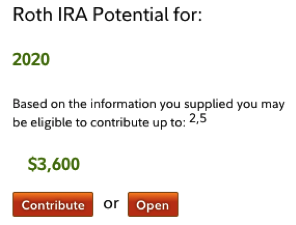

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Hsa Contribution Limits 2022 Calculator Internal Revenue Code Simplified

Sep Ira Contribution Calculator For Self Employed Persons